|

As the deregulated natural gas market has evolved, we have come to think of natural gas pricing as defined by the newsletters that report the trading at various market indexes and by the NYMEX that trades in the natural gas derivatives. Many buyers may be unaware that the price they pay for physical natural gas has several component parts, some of which are fixed and some of which are variable. In this discussion, we will review the components of natural gas pricing that are priced into the physical market, also referred to as the cash market. (The other market for natural gas, the Financial Market, mimics the physical market, but delivery of physical gas rarely occurs. The Financial Market is used primarily to manage price volatility and for speculation through the use of derivatives such as futures contracts and options on futures contracts and can trade up to 12 times the volumes represented by the physical market.) |

|

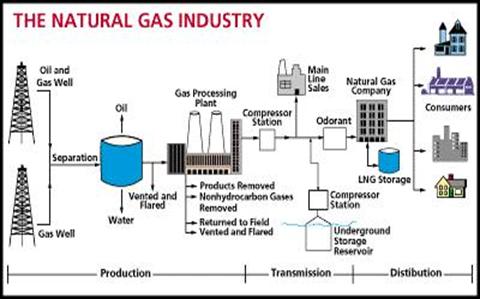

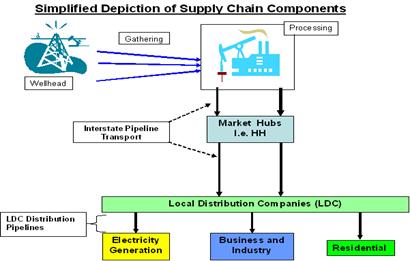

The next two diagrams depict the various process components that are necessary to deliver clean natural gas to the consumer. |

|

The primary parts that we will review include: Exploration and Production, Gathering, Processing, and Interstate Transportation and Local Distribution via Pipelines. |

|

Exploration and Production or Wellhead Costs While there are hundreds of natural gas producers in the natural gas industry, they all perform essentially the same functions in bringing their product to the market. Wellhead costs include: · Expenditures that involve the exploration for gas using state of the art seismic technology · Drilling actual gas wells to extract gas · Completion and production from the well There are risks involved in each of these processes because there is never 100% certainty that gas will be found. Additionally, newer drilling technology and strategy are needed to drill in inhospitable or inaccessible locations and they can add significant cost. In this situation, the price of gas has to recover these additional costs as well as the risk premium that is involved |

|

Offshore platform in the Gulf of Mexico |

|

Land-based wells (Source: DOE) |

|

Gathering Once a well is producing, the natural gas must be moved to the next step in the process on its way to the End-user. In most instances, a producing well is part of a larger producing field that consists of many, sometimes hundreds, of producing wells. A complex gathering system can consist of thousands of miles of pipes, interconnecting a processing plant to as many as 100 wells in an area. Using a common processing plant rather than one for each well is the most economical way to process gas. Gathering systems can be owned by the wellhead owners, the processing plant owners or by independent third parties. The cost of the gathering system becomes a fixed adder to the price at the wellhead and in most circumstances is set by tariff. According to the American Gas Association, there is more than 37,000 miles of gathering system pipelines in the U.S. |

|

Processing Natural gas found at the wellhead is by no means pure methane. Whatever the source of the natural gas, it commonly exists in mixture with other hydrocarbons; principally ethane, propane, butane, and pentanes. In addition, raw natural gas contains water vapor, hydrogen sulfide, carbon dioxide, helium, nitrogen, and other compounds that must be removed before it can be transported and used by the consumer as “pipeline quality” dry natural gas. The ethane, propane, butane, and pentanes (known as Natural Gas Liquids (NGL)) that are removed are sold separately and have a variety of different uses; including enhancing oil recovery in oil wells, providing raw materials for oil refineries or petrochemical plants, and as sources of energy. The cost of processing natural gas is primarily a fixed cost and cannot be avoided. |

|

The output of the processing plant is “pipeline quality” gas as it enters the interstate pipeline system. It is at this point that End-users and Marketers start to interface in the process. It is also at this point that the price of natural gas can be termed the “Commodity Cost”. |

|

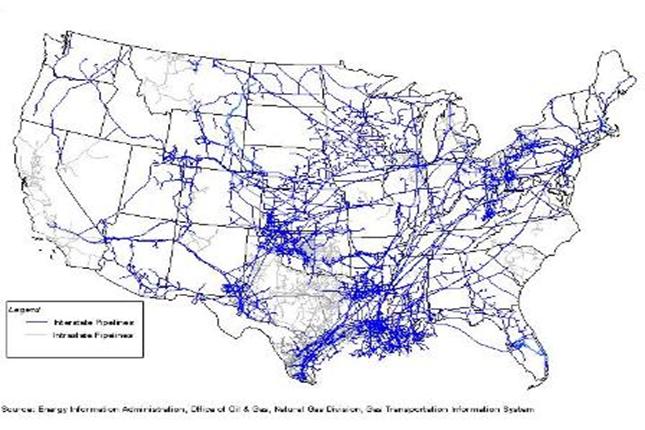

Interstate Pipeline Transportation The Interstate Natural Gas Pipeline Network is the “highway” of natural gas that transports processed natural gas from processing plants in producing regions to those areas with natural gas use requirements, particularly large, populated urban areas. The pipeline network extends across the entire country and the natural gas is transported at pressures anywhere from 200 to 1500 pounds per square inch (psi). These pressures reduce the volume of the natural gas being transported by up to 600 times (reducing required pipeline sizes) and provide the force required to move the natural gas through the pipeline. |

|

Marketers and large End-users can contract for capacity on the more than 300,000 miles of pipeline to move their gas to desired destinations. Market Hubs are geographic points where many marketers and/or end-users trade gas, and they have become points of purchase and sale for the financial market as well. There are about 30 major Market Hubs along with many minor ones. |

|

Pipeline transport rates are regulated. When a contract is executed with a pipeline for the movement of gas, the costs are defined by Tariff and its terms must be adhered to during the length of the contract. Pipeline rates usually have two components; one is fixed and the other is variable with volume. A receipt and a delivery point is also defined. In the financial market, the difference between market hubs or points on the pipeline system is referred to as “basis”. Basis is variable and is not regulated. Basis is often significantly different from the contractually fixed rates in the physical market and tends to reflect various market conditions that may arise. In addition to gas movement, the Interstate Pipelines offer a variety of transportation related services and transportation rates can also reflect the degree of interruption risk a transporter is willing to take. Most natural gas that moves on the Interstate Pipeline System is delivered to a Local Distribution Company (LDC). |

|

“Stringing” the Pipe (Source: Duke Energy Gas Transmission Canada) |

|

Distribution Distribution is the final step in delivering natural gas to end users. While some large industrial, commercial, and electric generation customers receive natural gas directly from high capacity Interstate and Intrastate pipelines (usually contracted through natural gas marketing companies), most other users receive natural gas from a Local Distribution Company (LDC). Typically, LDCs take ownership of the natural gas at their interconnection points on the Interstate and Intrastate pipelines, also called their “Citygate”, and then deliver it to each individual customer's location of use. This requires an extensive network of small-diameter distribution pipe; it has been estimated that there exist over one million miles of distribution pipe in the United States. Because of the transportation infrastructure required to move natural gas to many diverse customers across a reasonably wide geographic area, distribution costs typically make up the majority of natural gas costs for small volume end users. While large interstate pipelines can reduce unit transport costs by transmitting large volumes of natural gas, distribution companies must deliver relatively small volumes to many more different locations. According to the Energy Information Administration (EIA), the distribution cost for a typical small volume residential natural gas consumer, can represent up to 47 percent of the natural gas bill (see chart). |

|

Components of Residential Natural Gas Price, Source: EIA |

|

For larger industrial consumers, the percentage can be much less, but still represents a significant portion of the overall cost; the commodity portion of the total natural gas cost can represent about 65 to 70% of the price. |

|

Summary It is evident from our discussion that natural gas price is not just the “pseudo” commodity price that we have all become familiar with in everyday natural gas pricing (both NYMEX and cash). Rather, it is the true commodity price plus the add-ons for transport and other delivery related costs not discussed. In fact, the commodity price, while being a significant portion of the total price, can be as little as only 34% of the total price to some consumers.

It is prudent therefore, that the consumer pays close attention to all parts of the supply chain and their individual cost. Opportunity to control total price lies in controlling individual component cost. One part of good Energy Management is doing just that. |

|

Natural Gas Basics |

|

A Natural Gas Processing Plant Source: Duke Energy Gas Transmission Canada |